Improving the Numerical Understanding of Children From Low-income Families

Chapter 14. Poverty and Economic Inequality

14.5 Government Policies to Reduce Income Inequality

Learning Objectives

By the end of this section, you will be able to:

- Explain the arguments for and against authorities intervention in a market economic system

- Identify benign ways to reduce the economic inequality in a guild

- Prove the tradeoff between incentives and income equality

No society should look or desire complete equality of income at a given point in time, for a number of reasons. Commencement, most workers receive relatively low earnings in their first few jobs, higher earnings as they reach middle historic period, and and so lower earnings later retirement. Thus, a society with people of varying ages will have a certain corporeality of income inequality. 2d, people's preferences and desires differ. Some are willing to work long hours to have income for large houses, fast cars and computers, luxury vacations, and the ability to back up children and grandchildren.

These factors all imply that a snapshot of inequality in a given yr does non provide an accurate moving picture of how people's incomes rise and fall over time. Even if some degree of economic inequality is expected at whatsoever point in time, how much inequality should at that place be? In that location is as well the difference between income and wealth, as the following Clear It Up feature explains.

How exercise you lot mensurate wealth versus income inequality?

Income is a menses of money received, often measured on a monthly or an annual basis; wealth is the sum of the value of all avails, including money in banking company accounts, financial investments, a pension fund, and the value of a home. In calculating wealth all debts must be subtracted, such as debt owed on a home mortgage and on credit cards. A retired person, for example, may have relatively little income in a given year, other than a pension or Social Security. However, if that person has saved and invested over time, the person's accumulated wealth can be quite substantial.

In the United States, the wealth distribution is more than unequal than the income distribution, considering differences in income tin can accumulate over fourth dimension to make fifty-fifty larger differences in wealth. Even so, the degree of inequality in the wealth distribution can be measured with the same tools nosotros use to measure the inequality in the income distribution, like quintile measurements. Data on wealth are collected once every iii years in the Survey of Consumer Finance.

Even if they cannot reply the question of how much inequality is also much, economists can withal play an important role in spelling out policy options and tradeoffs. If a social club decides to reduce the level of economic inequality, it has three primary sets of tools: redistribution from those with high incomes to those with low incomes; trying to clinch that a ladder of opportunity is widely available; and a taxation on inheritance.

Redistribution

Redistribution means taking income from those with college incomes and providing income to those with lower incomes. Earlier in this chapter, we considered some of the key government policies that provide support for the poor: the welfare programme TANF, the earned income tax credit, SNAP, and Medicaid. If a reduction in inequality is desired, these programs could receive additional funding.

The programs are paid for through the federal income revenue enhancement, which is a progressive tax system designed in such a style that the rich pay a college per centum in income taxes than the poor. Data from household income tax returns in 2009 shows that the top 1% of households had an average income of $i,219,700 per year in pre-tax income and paid an boilerplate federal tax rate of 28.9%. The effective income taxation, which is total taxes paid divided by total income (all sources of income such every bit wages, profits, interest, rental income, and government transfers such every bit veterans' benefits), was much lower. The effective revenue enhancement paid by the pinnacle 1% of householders was 20.4%, while the lesser two quintiles actually paid negative constructive income taxes, because of provisions like the earned income tax credit. News stories occasionally study on a high-income person who has managed to pay very piddling in taxes, but while such private cases be, according to the Congressional Budget Role, the typical pattern is that people with higher incomes pay a college average share of their income in federal income taxes.

Of class, the fact that some degree of redistribution occurs now through the federal income taxation and government antipoverty programs does not settle the questions of how much redistribution is appropriate, and whether more redistribution should occur.

The Ladder of Opportunity

Economical inequality is perhaps virtually troubling when it is non the result of effort or talent, but instead is adamant by the circumstances under which a kid grows upwardly. I child attends a well-run grade school and high school and heads on to college, while parents assistance out by supporting education and other interests, paying for college, a first auto, and a first firm, and offering work connections that lead to internships and jobs. Some other child attends a poorly run grade school, barely makes information technology through a low-quality high school, does non go to college, and lacks family unit and peer support. These 2 children may be similar in their underlying talents and in the endeavour they put forth, but their economic outcomes are likely to be quite dissimilar.

Public policy tin attempt to build a ladder of opportunities then that, fifty-fifty though all children will never come up from identical families and attend identical schools, each child has a reasonable opportunity to attain an economic niche in society based on their interests, desires, talents, and efforts. Some of those initiatives include those shown in Table 13.

| Children | Higher Level | Adults |

|---|---|---|

| • Improved day care | • Widespread loans and grants for those in financial need | • Opportunities for retraining and acquiring new skills |

| • Enrichment programs for preschoolers | • Public support for a range of institutions from ii-year customs colleges to large research universities | • Prohibiting discrimination in task markets and housing on the ground of race, gender, historic period, and disability |

| • Improved public schools | – | – |

| • After school and customs activities | – | – |

| • Internships and apprenticeships | – | – |

| Table xiii. Public Policy Initiatives | ||

The United States has often been called a country of opportunity. Although the general idea of a ladder of opportunity for all citizens continues to exert a powerful allure, specifics are ofttimes quite controversial. Society can experiment with a wide variety of proposals for building a ladder of opportunity, especially for those who otherwise seem likely to start their lives in a disadvantaged position. Such policy experiments need to exist carried out in a spirit of open up-mindedness, considering some will succeed while others volition not testify positive results or will price also much to enact on a widespread footing.

Inheritance Taxes

There is always a debate about inheritance taxes. It goes like this: On the one mitt, why should people who have worked hard all their lives and saved upwardly a substantial nest egg not be able to requite their money and possessions to their children and grandchildren? In particular, it would seem united nations-American if children were unable to inherit a family unit business or a family habitation. On the other hand, many Americans are far more comfortable with inequality resulting from high-income people who earned their coin by starting innovative new companies than they are with inequality resulting from high-income people who have inherited money from rich parents.

The The states does have an manor tax—that is, a taxation imposed on the value of an inheritance—which suggests a willingness to limit how much wealth can exist passed on every bit an inheritance. However, according to the Middle on Budget and Policy Priorities, in 2015 the estate revenue enhancement practical only to those leaving inheritances of more than than $v.43 one thousand thousand and thus applies to only a tiny percentage of those with high levels of wealth.

The Tradeoff between Incentives and Income Equality

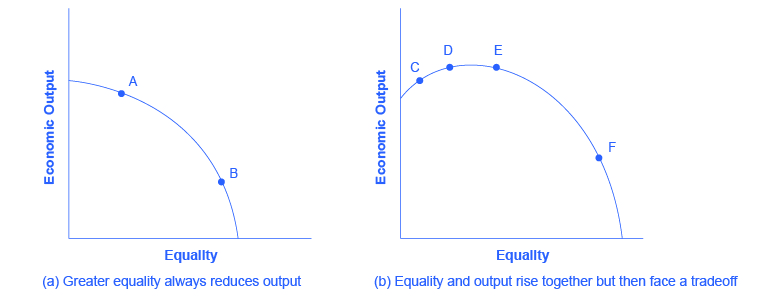

Government policies to reduce poverty or to encourage economic equality, if carried to extremes, can hurt incentives for economic output. The poverty trap, for example, defines a state of affairs where guaranteeing a certain level of income can eliminate or reduce the incentive to piece of work. An extremely high caste of redistribution, with very high taxes on the rich, would exist probable to discourage work and entrepreneurship. Thus, it is common to draw the tradeoff betwixt economic output and equality, equally shown in Effigy 1 (a). In this formulation, if society wishes a high level of economical output, similar point A, it must likewise accept a high degree of inequality. Conversely, if club wants a high level of equality, like point B, it must accept a lower level of economic output because of reduced incentives for production.

This view of the tradeoff between economic output and equality may be too pessimistic, and Figure i (b) presents an alternate vision. Here, the tradeoff betwixt economic output and equality first slopes up, in the vicinity of choice C, suggesting that certain programs might increase both output and economical equality. For example, the policy of providing free public pedagogy has an chemical element of redistribution, since the value of the public schooling received past children of low-income families is clearly higher than what low-income families pay in taxes. A well-educated population, even so, is besides an enormously powerful cistron in providing the skilled workers of tomorrow and helping the economic system to grow and expand. In this case, equality and economical growth may complement each other.

Moreover, policies to diminish inequality and soften the hardship of poverty may sustain political back up for a market economy. Later on all, if guild does not make some effort toward reducing inequality and poverty, the alternative might be that people would rebel against market forces. Citizens might seek economical security past enervating that their legislators pass laws forbidding employers from always laying off workers or reducing wages, or laws that would impose price floors and toll ceilings and shut off international trade. From this viewpoint, policies to reduce inequality may help economic output by edifice social support for allowing markets to operate.

The tradeoff in Figure 1 (b) and then flattens out in the area between points D and E, which reflects the blueprint that a number of countries that provide similar levels of income to their citizens—the The states, Canada, the nations of the European union, Nihon, Australia—take different levels of inequality. The pattern suggests that countries in this range could choose a greater or a lesser degree of inequality without much impact on economic output. Only if these countries push for a much college level of equality, like at bespeak F, will they feel the macerated incentives that lead to lower levels of economical output. In this view, while a danger e'er exists that an agenda to reduce poverty or inequality tin can be poorly designed or pushed too far, it is also possible to find and blueprint policies that improve equality and do not hurt incentives for economical output by very much—or even meliorate such incentives.

Occupy Wall Street

The Occupy movement took on a life of its own over the last few months of 2011, bringing to light issues faced by many people on the lower end of the income distribution. The contents of this affiliate indicate that there is a significant corporeality of income inequality in the United states. The question is: What should be washed about information technology?

The Great Recession of 2008–2009 caused unemployment to rise and incomes to fall. Many people aspect the recession to mismanagement of the financial organisation by bankers and financial managers—those in the i% of the income distribution—only those in lower quintiles diameter the greater brunt of the recession through unemployment. This seemed to present the picture of inequality in a different calorie-free: the grouping that seemed responsible for the recession was not the group that seemed to bear the burden of the refuse in output. A burden shared can bring a society closer together; a burden pushed off onto others can polarize it.

On i level, the trouble with trying to reduce income inequality comes down to whether you still believe in the American Dream. If yous believe that one mean solar day y'all will take your American Dream—a large income, large firm, happy family, or whatever else you would like to take in life—then you practice not necessarily want to prevent anyone else from living out their dream. You lot certainly would not want to run the take chances that someone would want to take part of your dream away from you. And so there is some reluctance to engage in a redistributive policy to reduce inequality.

Yet, when those for whom the likelihood of living the American Dream is very small are considered, there are sound arguments in favor of trying to create greater balance. Every bit the text indicated, a little more income equality, gained through long-term programs like increased educational activity and job training, tin increase overall economic output. Then everyone is made ameliorate off. And the ane% will not seem like such a small grouping any more.

Cardinal Concepts and Summary

Policies that tin bear upon the level of economic inequality include redistribution between rich and poor, making it easier for people to climb the ladder of opportunity; and estate taxes, which are taxes on inheritances. Pushing likewise aggressively for economic equality can run the risk of decreasing economic incentives. However, a moderate push for economical equality can increase economical output, both through methods like improved instruction and past edifice a base of political support for market place forces.

Self-Check Questions

- Here is ane hypothesis: A well-funded social safety net can increase economical equality simply will reduce economic output. Explicate why this might be so, and sketch a production possibility bend that shows this tradeoff.

- Here is a 2d hypothesis: A well-funded social prophylactic internet may lead to less regulation of the market economy. Explain why this might be so, and sketch a product possibility curve that shows this tradeoff.

- Which set up of policies is more likely to cause a tradeoff between economic output and equality: policies of redistribution or policies aimed at the ladder of opportunity? Explain how the production possibility frontier tradeoff between economic equality and output might await in each case.

- Why is in that location reluctance on the function of some in the United States to redistribute income then that greater equality can be achieved?

Review Questions

- Identify some public policies that can reduce the level of economical inequality.

- Draw how a push for economic equality might reduce incentives to work and produce output. Then describe how a push button for economic inequality might non have such furnishings.

Critical Thinking Questions

- What practise you call up is more important to focus on when considering inequality: income inequality or wealth inequality?

- To reduce income inequality, should the marginal tax rates on the top 1% be increased?

- Redistribution of income occurs through the federal income tax and regime antipoverty programs. Explicate whether or not this level of redistribution is appropriate and whether more redistribution should occur.

- How does a society or a land brand the decision about the tradeoff between equality and economical output? Hint: Call back almost the political organization.

- Explain what the long- and short-term consequences are of non promoting equality or working to reduce poverty.

References

Board of Governors of the Federal Reserve System. "Research Resources: Survey of Consumer Finances." Concluding modified December xiii, 2013. http://www.federalreserve.gov/econresdata/scf/scfindex.htm.

Congressional Upkeep Office. "The Distribution of Household Income and Federal Taxes, 2008 and 2009." Last modified July 10, 2012. http://www.cbo.gov/publication/43373.

Huang, Chye-Ching, and Nathaniel Frentz. "Myths and Realities Most the Estate Revenue enhancement." Center on Upkeep and Policy Priorities. Concluding modified August 29, 2013. http://www.cbpp.org/files/estatetaxmyths.pdf.

Glossary

- constructive income tax

- percentage of full taxes paid divided past total income

- estate tax

- a revenue enhancement imposed on the value of an inheritance

- income

- a menses of money received, often measured on a monthly or an annual basis

- progressive tax system

- a tax system in which the rich pay a higher percentage of their income in taxes, rather than a college accented corporeality

- redistribution

- taking income from those with higher incomes and providing income to those with lower incomes

- wealth

- the sum of the value of all assets, including coin in banking concern accounts, fiscal investments, a pension fund, and the value of a dwelling house

Solutions

Answers to Self-Check Questions

- A very strong push button for economical equality might include extremely high taxes on high-wage earners to pay for extremely large government social payments for the poor. Such a policy could limit incentives for the loftier-wage workers, lock the poor into a poverty trap, and thus reduce output. The PPF in this case will have the standard appearance: it will exist downward sloping.

- For the 2nd hypothesis, a well-funded social prophylactic cyberspace might brand people experience that even if their visitor goes bankrupt or they need to change jobs or industries, they will have some degree of protection. Every bit a event, people may be more willing to allow markets to work without interference, and non to lobby as hard for rules that would prevent layoffs, set price controls, or block strange trade. In this case, safety net programs that increase equality could besides allow the market to piece of work more than freely in a style that could increase output. In this instance, at to the lowest degree some portion of the PPF betwixt equality and economic output would gradient upwardly.

- Pure redistribution is more likely to cause a sharp tradeoff between economic output and equality than policies aimed at the ladder of opportunity. A production possibility frontier showing a strict tradeoff between economic output and equality will be downward sloping. A PPF showing that it is possible to increase equality, at least to some extent, while either increasing output or at to the lowest degree not diminishing it would take a PPF that first rises, perchance has a flat area, and then falls.

- Many view the redistribution of income to achieve greater equality as taking away from the rich to pay the poor, or as a "zero sum" game. By taking taxes from one group of people and redistributing them to some other, the revenue enhancement organisation is robbing some of the American Dream.

Source: https://opentextbc.ca/principlesofeconomics/chapter/14-5-government-policies-to-reduce-income-inequality/

0 Response to "Improving the Numerical Understanding of Children From Low-income Families"

Post a Comment